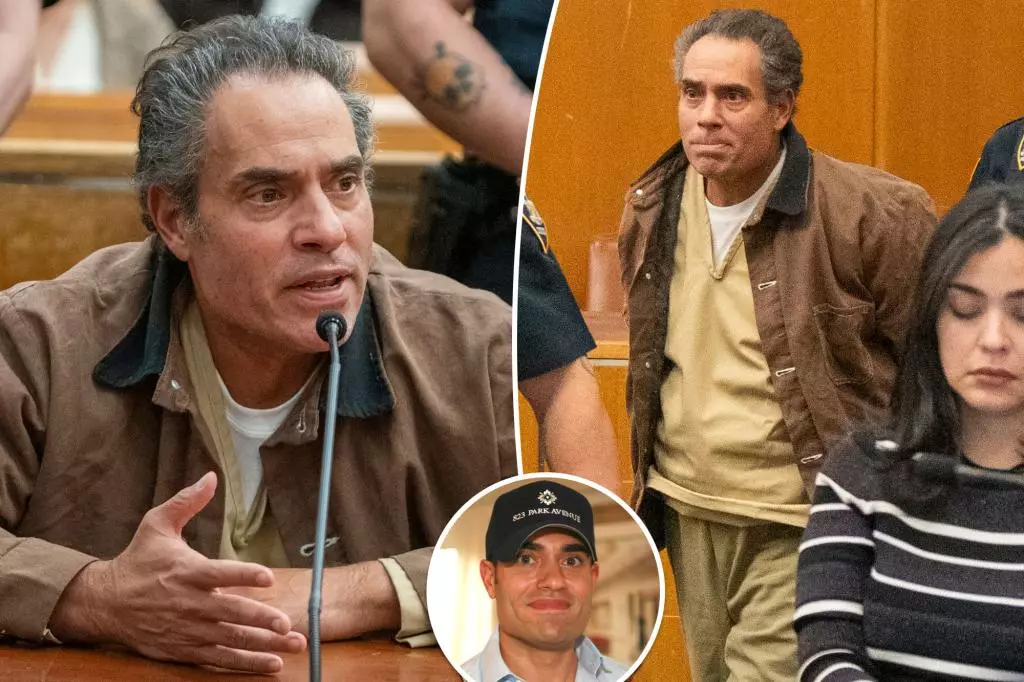

NYC developer Nir Meir was once known for his extravagant lifestyle, filled with fine wines, exotic cars, and lavish parties. He sold a mansion in Southampton for $43 million and lived on the same street as finance titans like Ken Griffin and Leon Black. Meir was notorious for popping $50,000 bottles of wine and hosting luxurious dinners with expensive scotch and cigars. His estate was a hub for opulent gatherings, including omakase nights and Sunday pizza parties that cost thousands of dollars.

Despite his affluent lifestyle, Meir’s world came crashing down when he was charged with grand larceny, tax fraud, and falsifying business records. He declared bankruptcy and claimed to be broke, unable to post his $5 million cash bond. His Hamptons home, once a symbol of luxury, was marred with lawsuits and a messy divorce. Allegations surfaced that Meir had spent exorbitant sums on wine, strip clubs, private jets, and yachts, leaving his former business partner in shock at the extent of his spending.

The Downfall

Meir’s legal battles shed light on his once-lavish lifestyle, revealing excessive spending habits that were unsustainable. His monthly expenses, including $6,000 at a strip club in Miami, painted a picture of a man living beyond his means. Despite his claims of innocence and being an upstanding citizen, Meir’s financial downfall exposed a darker side to his success in the real estate industry. Prosecutors accuse him of defrauding investors, subcontractors, and the city of New York in a scheme totaling $86 million.

Now facing multiple legal battles and mounting debts, Meir’s reputation as a prominent developer has been tarnished. His lavish spending and extravagant lifestyle have been replaced with court appearances and bankruptcy proceedings. The once-glamorous facade of wealth and success has crumbled, leaving behind a trail of accusations and unanswered questions. As Meir navigates the fallout of his legal troubles, his story serves as a cautionary tale of the dangers of excessive indulgence and financial irresponsibility in the high-stakes world of real estate.